POLICY WATCH 360 — By Uye Vincent

At its 302nd Monetary Policy Committee meeting in Sept, 22-23, 2025 the Central Bank of Nigeria (CBN) announced a 50 basis point cut to the Monetary Policy Rate (MPR), bringing it down from 27.50 percent to 27.00 percent. Alongside the rate cut, the MPC narrowed the interest rate corridor to ±250 basis points around the MPR and adjusted the Cash Reserve Ratio (CRR) for commercial banks to 45 percent.

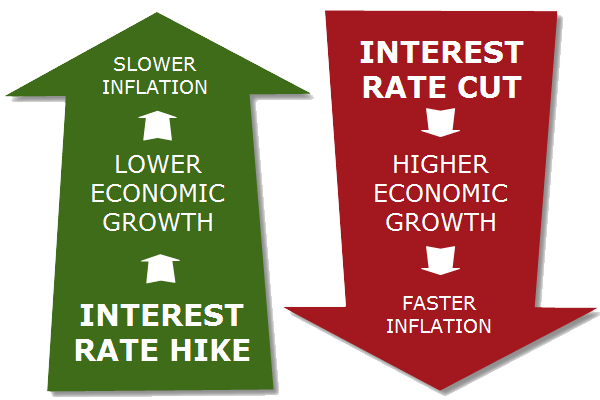

The decision marks a clear pivot from the previous aggressive tightening cycle that had persisted for several years. The CBN cited sustained disinflation trends inflation having eased over five consecutive months and a stabilizing macro environment as the rationale for the shift.

Governor Olayemi Cardoso noted that the committee was “confident in the ability of the economy to respond” and that modest easing would help stimulate growth without derailing price stability.

Implications & Risks

The cut could ease borrowing costs, nudging banks to lend more to businesses and households and potentially reviving investment and consumption. The narrower corridor aims to enhance the effectiveness of rate transmission in the interbank market.

However, risks remain. Excess liquidity in the banking system partly fueled by strong fiscal inflows—could undermine the disinflation gains.There is also the danger that fiscal expansion (especially subsidy or debt servicing costs) may offset the monetary easing, making the CBN’s job harder. Mixed signals from external shocks or imported inflationary pressures could force a course correction.

Going forward, market watchers will scrutinize whether follow through rate cuts occur, how banks respond in terms of credit supply, and whether fiscal discipline and better coordination reinforce the CBN’s gain in credibility.