By UYE VINCENT

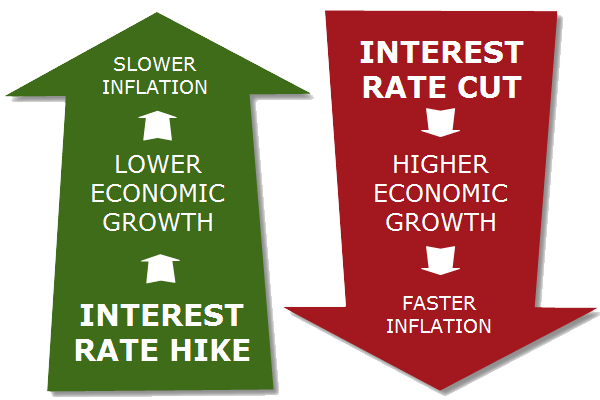

The Central Bank of Nigeria (CBN) has reduced its benchmark interest rate also known as the Monetary Policy Rate (MPR) — from 27.5 percent to 27 percent, marking the first rate cut in five years. The decision, announced at the 302nd Monetary Policy Committee (MPC) meeting, reflects cautious optimism about easing inflation and improving economic stability.

According to CBN Governor Olayemi Cardoso, the cut is part of a balanced strategy to sustain disinflation while stimulating business activity. He noted that headline inflation, which had accelerated earlier in the year, has started to moderate due to tighter liquidity control and improved food supply.

For small businesses and households, the immediate effect may be subtle but significant over time. Lower policy rates typically reduce borrowing costs for banks, which can translate into cheaper loans for enterprises and individuals seeking credit.

However, analysts caution that the benefits may take a few months to materialize, as banks adjust lending terms gradually. Savers could also earn slightly less interest as deposit rates fall.

The CBN’s move signals growing confidence in Nigeria’s macroeconomic path with stable exchange rates, improved fiscal coordination, and stronger investor sentiment. If inflation continues to ease, further rate adjustments could follow later in the year, supporting sustainable growth.