Nigeria is ramping up fiscal reforms to stabilize public finances and attract investment, even as debt obligations rise amid global economic pressures.

The government has stepped up subsidy rationalization, tax collection, and expenditure control to narrow the budget deficit, currently around 5% of GDP. Analysts warn that over 60% of revenue goes to debt servicing, limiting funds for capital projects. Still, authorities are optimistic, pointing to public-private partnerships and concessional borrowing to fund infrastructure.

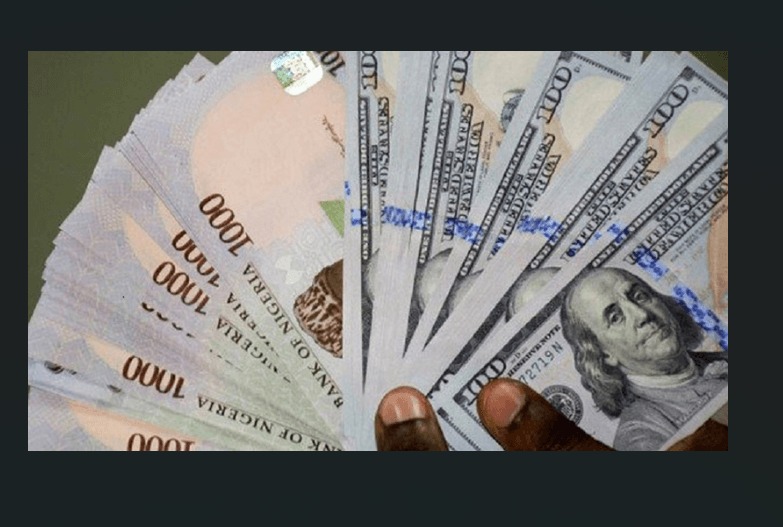

Investor confidence is rising, supported by reforms in foreign exchange management and fiscal transparency. International agencies, including Fitch Ratings, note that while Nigeria’s debt remains high, sustained fiscal discipline could gradually improve credit conditions.

The Medium-Term Expenditure Framework (MTEF) aims to boost non-oil revenue through digital taxation, customs automation, and expanding the formal tax base. Experts emphasize that these reforms must be backed by strong institutional accountability.

Investors are also watching policies to strengthen local manufacturing and reduce import dependence, central to Nigeria’s fiscal diversification strategy.

In the near term, disciplined fiscal management and effective debt control will be key to restoring confidence and supporting inclusive economic growth.